Which of the Following Groups Is Not Among Financial Intermediaries

2 and 3 only. A financial intermediary helps to facilitate the different needs of lenders and borrowers.

According to the US.

. Low Returns on Investment. 1 Securitisation is the conversion of illiquid assets into marketable securities2 The reverse yield gap refers to equity yields being higher than debt yields3 Disintermediation arises where borrowers deal directly with lending individuals. Investment companies are frequently called mutual funds.

Accordingly they create new forms of capital. Mutual fund managers B. For example if you need to borrow 1000 you could try to find an individual who wants to lend 1000.

Reveal answer Formulae tables. Answer A is correct. WINDOWPANE is the live-streaming social network and multi-media app for recording and sharing your amazing life.

Financial intermediaries increase the efficiency of financial markets. Kaneppeleqw and 5 more users found this answer helpful. An investment bank A pension fund A hardware store None of the above.

Bureau of Labor Statistics the insurance industry is expected to grow between 20 to 40 percent over the next 15 years. Are not financial intermediaries. A market is a group of individuals or organizations or both that need products in a given category and that have the ability willingness and authority to purchase them.

A financial intermediary offers a service to help an individual firm to save or borrow money. Common types include commercial banks investment banks stockbrokers pooled investment funds and stock exchanges. Which of the following is the name given to the market for intermediaries who buy finished products and sell them for a profit.

Which one of the following is not a financial intermediary. Grouping of financial intermediaries is not a matter of great importance for the interpretation of. Upvote 0 Downvote 0 Reply 0 Answer added by Wasi Rahman Sheikh WAREHOUSE SUPERVISOR AL MUTLAQ FURNITURE MFG.

A financial intermediary is a specialized firm that obtains funds from savers issues its own securities and uses the money to purchase a business s securities. Which of the following groups is not among financial intermediaries. 1 2 and 3.

Which of the following groups is not among financial intermediaries. Financial intermediaries which pool and manage the money of many investors are called A financial engineers B investment companies C investment bankers D credit unions Feedback. Commercial business is not a financial intermediary but this includes the distribution of goods services and this include all the asset and liabilities of the business and doesnt take into account the operations.

The ultimate aim of the financial intermediaries is to earn a profit and therefore they usually provide a low rate of interest on the investment made by the depositors. Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC. A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction.

To twice its current size Weegy. Faster than any other financial intermediary B. Which of the following is NOT an example of a financial intermediary.

Between 20 to 40 percent D. Post comments photos and videos or broadcast a live stream to friends family followers or everyone. Faster than any other non-intermediary financial institution C.

A financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. 1 and 3 only. Mutual funds are corporations that use.

But this would be very time consuming and you. A commercial bank An insurance company A pension fund A stock exchange. The most political issue in the FASBs most recent deliberations and amendments to GAAP on business combinations was.

Answer added by Deleted user. Which of the following is not a financial intermediary. Real estate investment trusts D.

2Which entity below is a financial intermediary. One very important difference among the financial intermediaries in the two groups exists but it does not. A disintermediary often allows the consumer to interact directly with the producing company.

No similar unifying principle can be claimed for the financial intermediaries in group D. Anything that removes the middleman intermediary in a supply chain. This indeed is a catch-all category.

As we already know that financial intermediaries operate for profits they are not charitable institutions. The following are some of its disadvantages. Financial intermediaries reallocate otherwise uninvested capital to productive enterprises through a.

The institutions that are commonly referred to as financial intermediaries include commercial banks.

Seven Trends At The Frontier Of Blockchain Banking Bcg

Bail In Execution Practices Paper Financial Stability Board

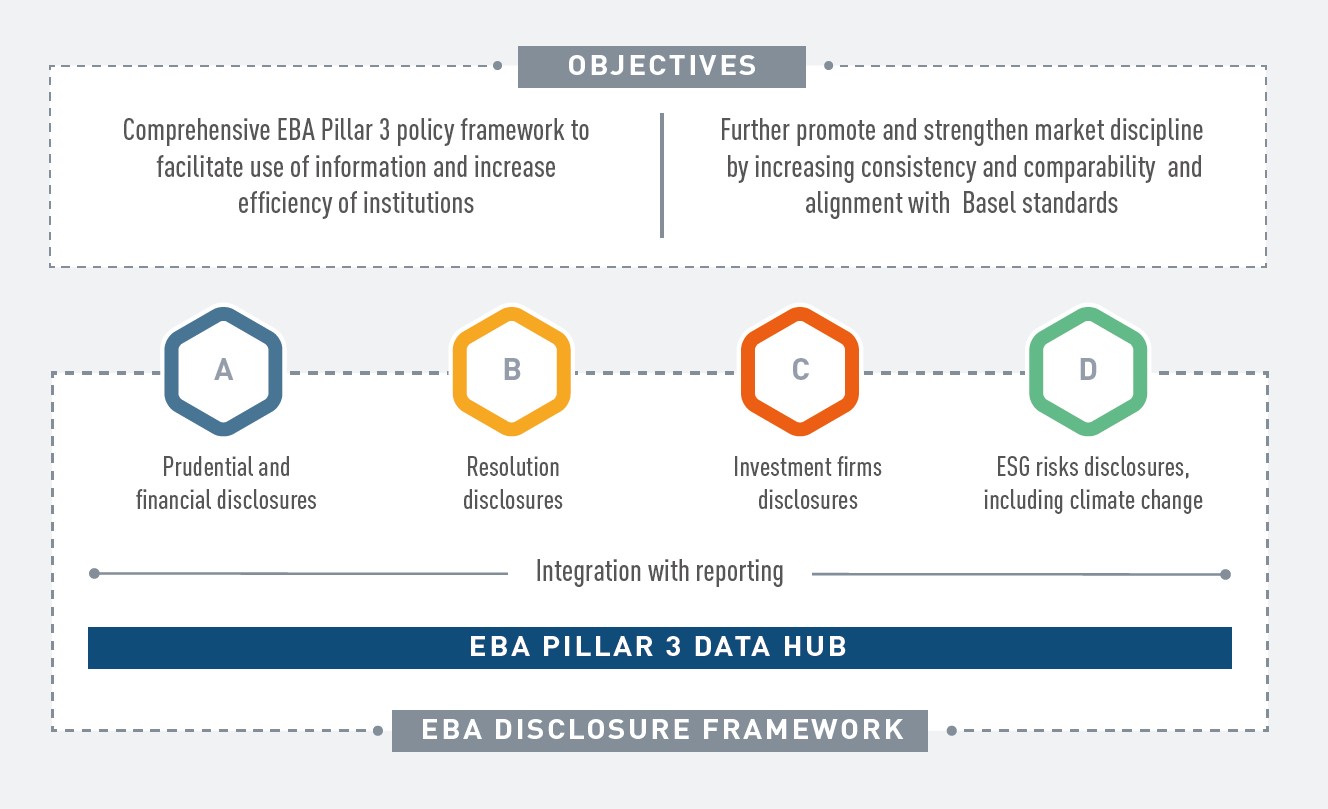

Transparency And Pillar 3 European Banking Authority

The Payments Industry Landscape What Does It Look Like Today Cardknox

No comments for "Which of the Following Groups Is Not Among Financial Intermediaries"

Post a Comment